After working with over 300 startups and seeing hundreds of millions raised, I can tell you: fundraising isn’t sales. It’s an entirely different game with its own rules, psychology, and winning strategies. Let’s look at mastering fundraising for your startup.

The Fundamentals: Why Fundraising Isn’t Sales

Mastering fundraising requires a fundamentally different mindset than sales. While salespeople focus on immediate value exchange, fundraising is about long-term potential and relationship building. Your goal isn’t to close a deal—it’s to find a partner who believes in your vision as much as you do.

The Numbers: What Mastering Fundraising Really Looks Like

An analysis of 200 successful Series A and Seed rounds reveals the stark reality of what it takes to raise capital:

Of the ones that were successful in raising money, they contacted 50 investors and secured meetings with 40 of them. The average fundraising cycle lasted 12.5 weeks (just under 100 days). Their pitch decks averaged 19 slides, but investors spent only 3 minutes and 44 seconds reviewing them via email. The most scrutinized slides when emailed were? Problem and Team slides.

The MOST Crucial Insight

Those who failed to raise money typically gave up within 6.7 weeks on average.

The lesson is clear—fundraising takes time. Persistence isn’t just helpful; it’s essential.

The Psychology: Inside the Investor’s Mind

The Risk vs. Greed Equation isn’t just theory—it’s the fundamental law of startup fundraising. Here’s how successful founders can manage this equation:

Building social proof through strategic advisors isn’t optional—it’s a cornerstone of reducing perceived risk. Create artificial scarcity with round size caps. Generate FOMO through parallel conversations. Most importantly, de-risk through continued, rapid execution and clear metrics throughout the course of your fundraising.

Big KEY

Want to know the paradox that kills most fundraising efforts? To get the money, you must first prove you don’t need it.

Investors want to follow momentum, not create it. That’s why continuing to make progress is so important even as you fundraise.

Mastering Fundraising: The Process

- Make a list of investors that are actually good targets for your round, thesis, and vertical. Make sure it is above 50 targets (see stats above on success).

- Figure out how you can reach these targets with a warm introduction. If you can’t get a warm introduction then get more targets.

- Batch your outreach to schedule meetings. Target 10-20 meetings per week for the first month to get through first meetings with as many possible. Try to get to 40 or more meetings (usually a zoom meeting for first meetings). By front loading the first meetings you are keeping investors on similar timelines which will create natural competition and urgency to keep moving.

- Follow up systematically. The investors will not say, “no” to you (they can’t because it will close off the option to invest in you). They will say, “This is interesting; please keep in touch,” which means “Continue to make progress and prove to me you don’t need the money.” Do just that: send monthly updates showcasing key metrics and milestones achieved.

- Follow their due diligence process.

- After about 50 first meetings with the requisite follow-ups as well as continued progress everything falls in place. You will literally have mastered fundraising because: a) your pitch is better, b) your terms are refine to market conditions from feedback with investors, c) your progress continues, and d) they know that you are pitching lots of investors. A potential lead investor or two are going to see this and want to set terms for investment before someone else does. You have lowered risk. You have increased greed.

- With two potential leads hopefully offering terms about the same time, it is time negotiate to get the deal that will get you a great partner, and not necessarily the best deal. Get the best investment partner on good terms. That’s winning

- Leverage the momentum of the finalized term sheet and lead investor to finish out your investment round. When one investor commits, will others follow. You are “marriage material” now. Use each commitment to create urgency with others still deciding.

- Oversubscribe only to get more value added investment partners into your company. Investors that will add value to your business and advocate for you. Possible even investors that will lead your next round.

- Complete the legal work, secure the cash, and get to work.

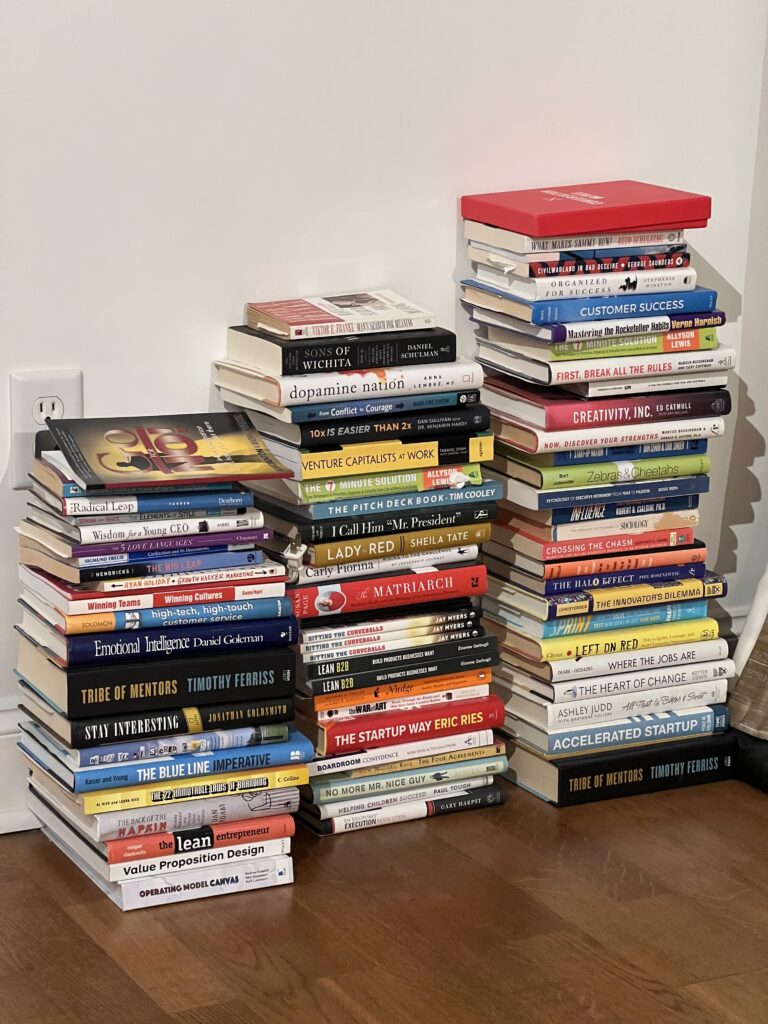

PS: Want to learn more about mastering fundraising add this book to your reading list for more info. And no investors won’t sign your NDAs. Here’s why.

The X-Factor of Securing Investment: Why Conviction Beats Everything

You aren’t begging for money. You have a viable business opportunity that stands to make you and your investors rich. They need to place investment capital.

Thus you need to walk into every room with unshakeable conviction. Not arrogance—conviction. Investors aren’t just betting on your idea; they’re betting on your ability to execute against all odds and get them returns. If you don’t believe in the inevitability of your success, neither will they.

Present an opportunity, not a plea. Investors can either join your journey or watch from the sidelines as you build something extraordinary. Their choice.

Mastering fundraising means leading with conviction.

The Path Forward

The path to greatness isn’t just about thinking bigger—it’s about executing smarter. Your fundraising journey starts now. Build your list. Craft your story. Create momentum. The capital will follow.

Remember: The best founders don’t raise money—they build empires.

From “good ideas” to “funding success,” the gap is filled with persistence, strategy, and tireless execution. Every successful raise follows these patterns. Now it’s your turn to put them into action.

Reach out if you want to talk about mastering fundraising for your business.